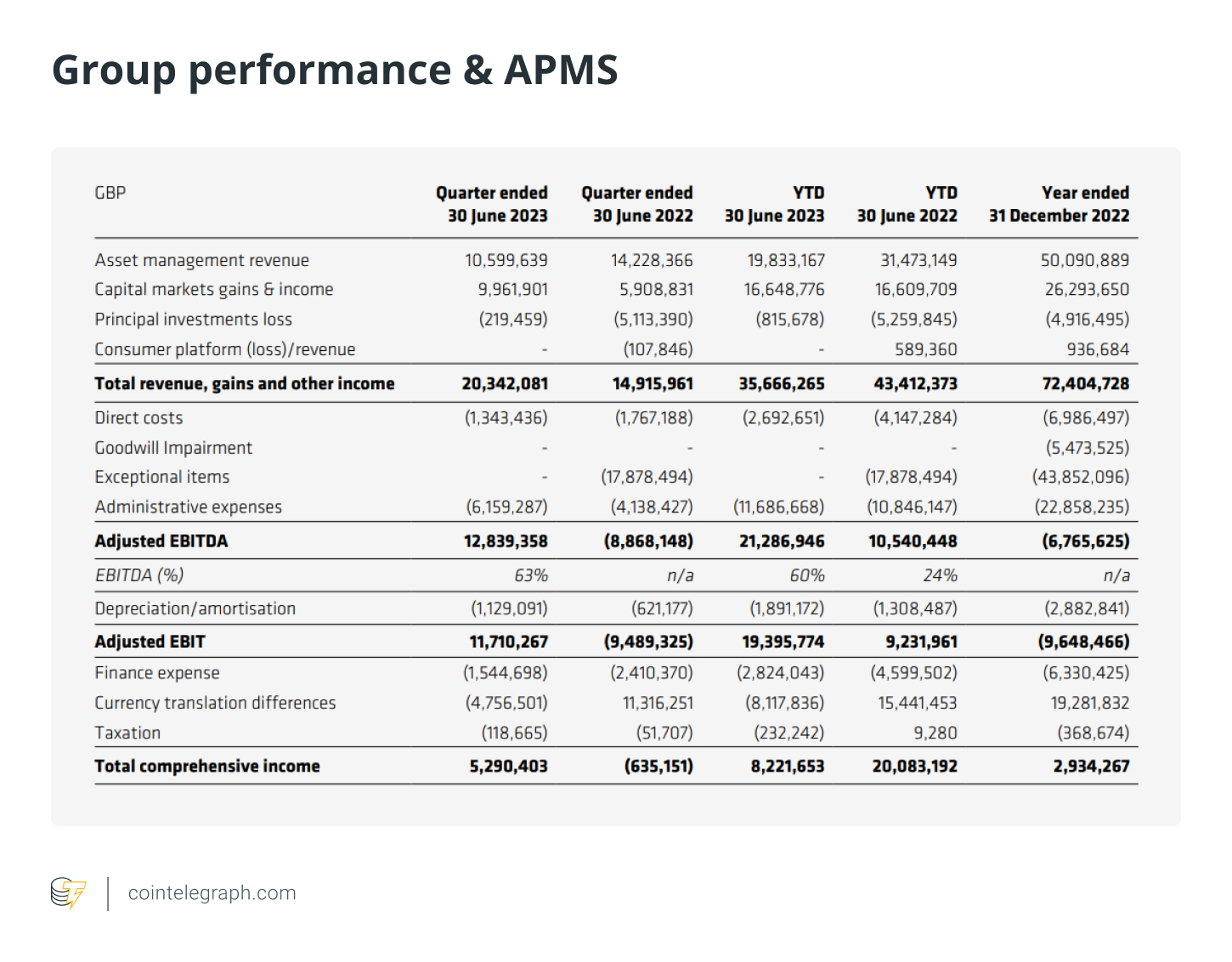

The rise in cryptocurrency prices and non-trading revenues became key to profitability for many crypto-focused companies.

Several crypto-centered public companies released quarterly earnings reports recently, revealing increased revenue and a jump in profits. Most of these crypto firms benefited from a rise in prices in the crypto market and a steady decline in bearish momentum, moving away from the crypto winter.

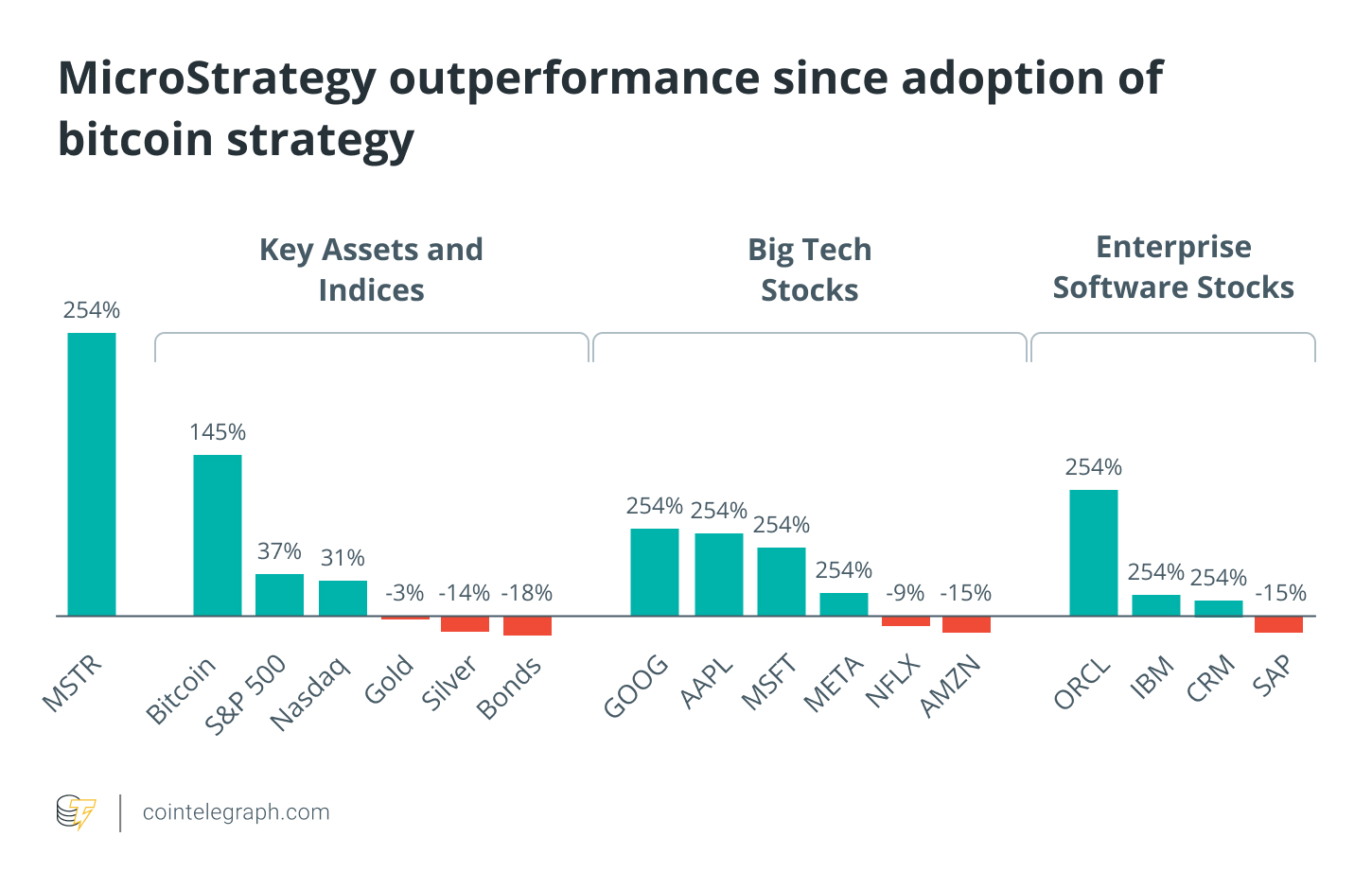

MicroStrategy: Bitcoin-focused institutional giant MicroStrategy turned profitable again in the second quarter thanks to the surge in the price of Bitcoin

BTC

$29,005

. MicroStrategy is one of the largest corporate holders of Bitcoin in the United States, with 152,800 BTC on its balance sheet as of July 31.

According to the earnings report filing on Aug.1, MicroStrategy reported $22.2 million in net income, a massive swing from a net loss of $1.1 billion in Q2 of 2022. The firm’s revenue remained flat at $120.4 million.

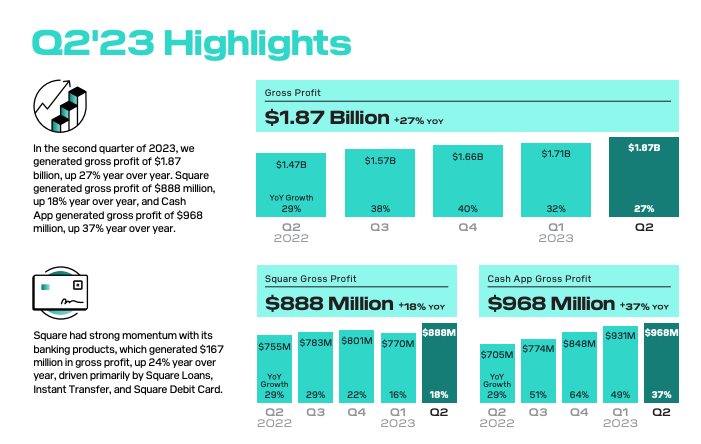

Block: Jack Dorsey-led Bitcoin payment company Block also beat early estimates to post a 34% year-on-year increase in its Bitcoin revenue. In an earnings report posted on Aug. 3, Block reported $2.4 billion in Bitcoin sales with a gross profit of $44 million, a 7% increase over the same period in 2022.

Block posted a 25.6% increase in revenue in Q2, from $4.4 billion to $5.53 billion year on year.

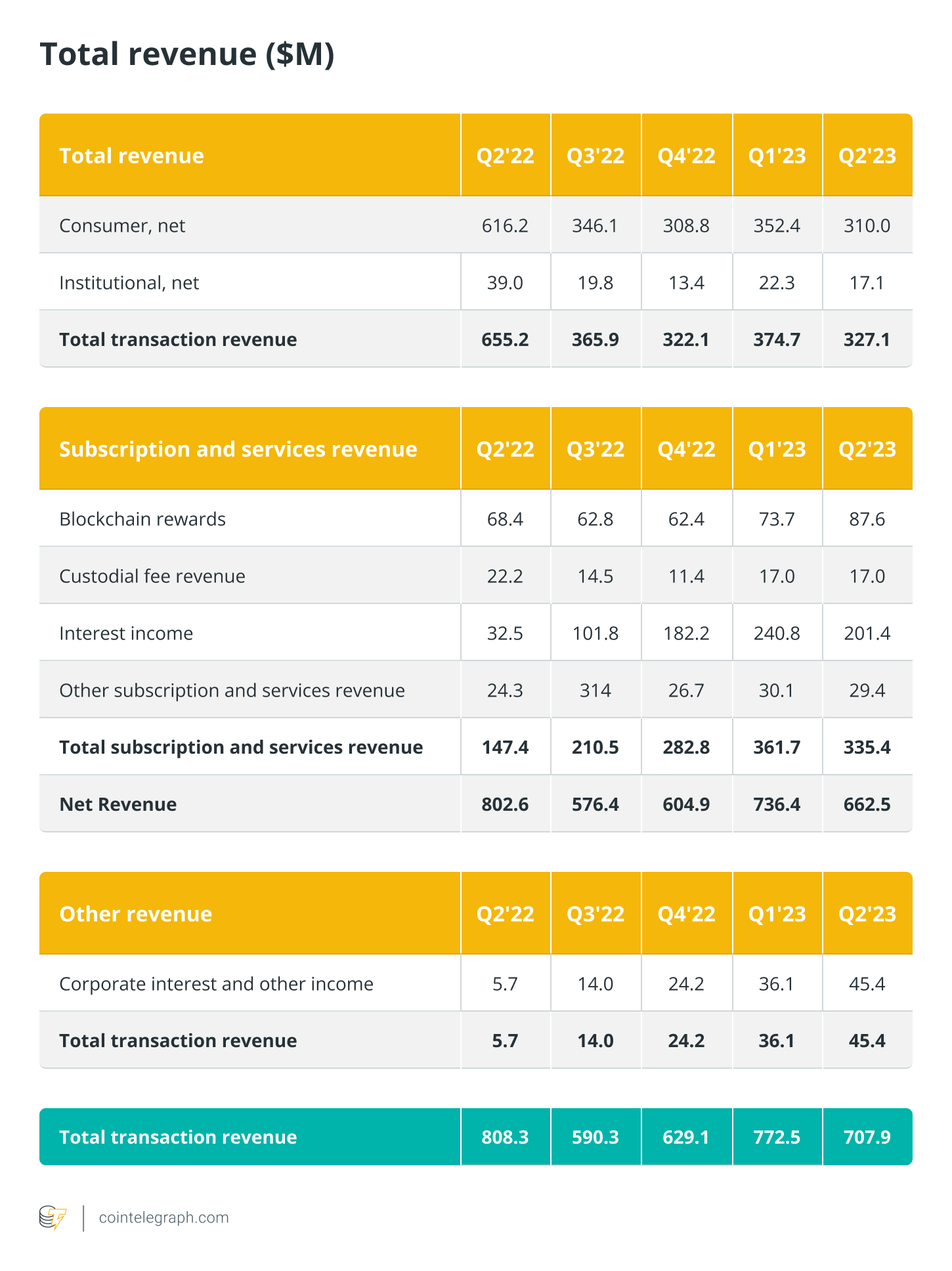

Coinbase: The first American crypto exchange to go public posted its quarterly earnings report on Aug. 3, beating early estimates to post $663 million in net revenue. Q2 also saw the exchange’s non-trading revenue surpass its trading revenue for the first time, with $335.4 million of net revenue coming from subscriptions and services.

Related: Cathie Wood’s ARK loads up crypto bags, buys $19.9M Block shares

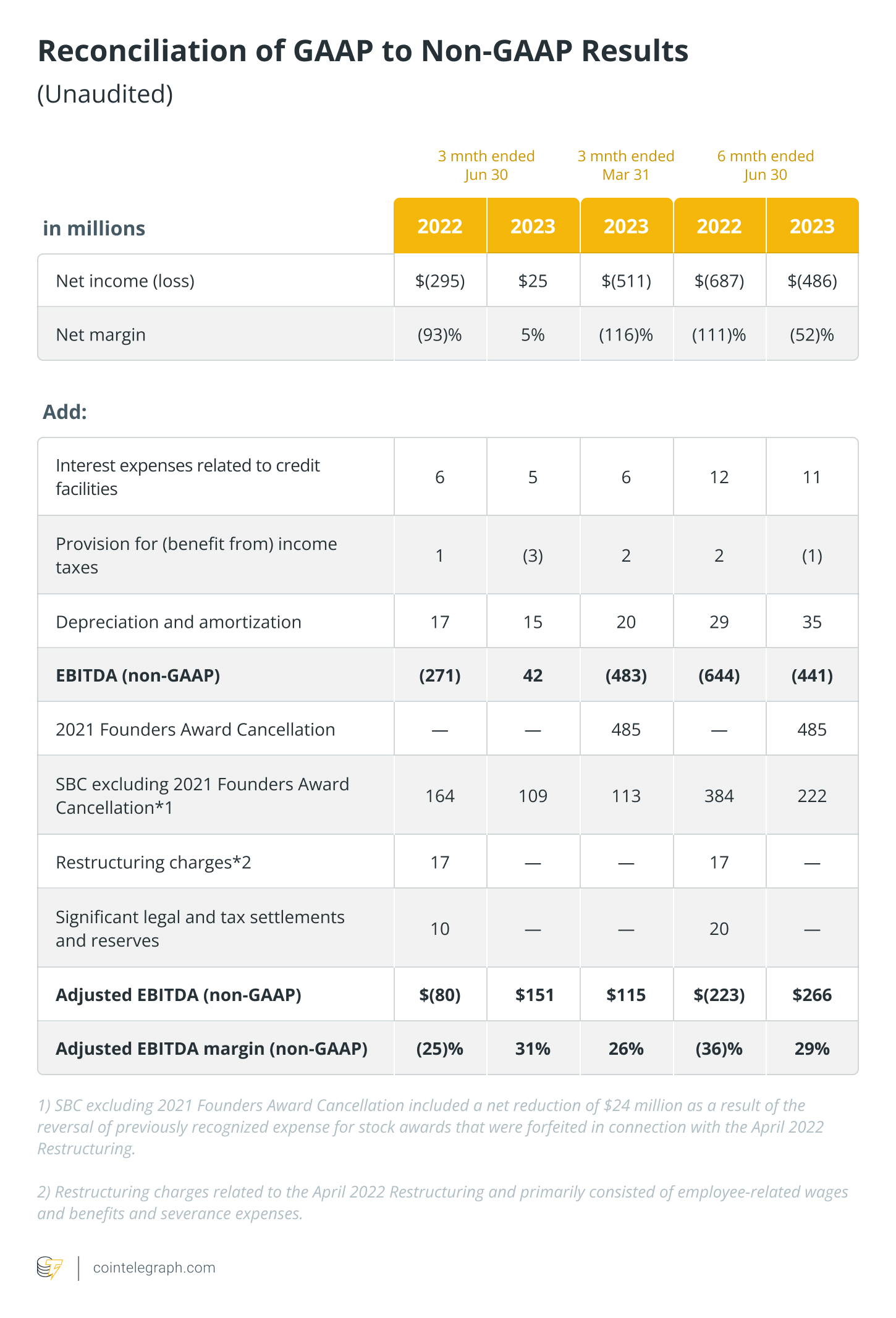

Robinhood: According to its quarterly earning report, fintech trading platform Robinhood became profitable for the first time since going public. The firm reported a net income of $25 million, or earnings per share of $0.03, compared with a net loss of $511 million, or earnings per share of -$0.57, in the first quarter of 2023.

Despite a reported net income of $25 million, the firm recorded a decline in revenue across crypto, equities and transaction-based revenue.