Can ChatGPT, the AI tool developed by OpenAI, revolutionize the landscape of cryptocurrency trading with its advanced language model and analytical capabilities

As Twitter, Instagram and TikTok users scroll through their feeds, reels and stories, compelling posts can catch their eye. Many of these posts claim that ChatGPT can turn anyone into a trading genius if offered the right prompts. Curiosity piqued, users are diving deeper into ChatGPT, an artificial intelligence (AI) phenomenon disrupting our society, technology, finance and even our very existence.

Can ChatGPT really help everyone become a trading wizard? That’s where things get intriguing.

Automated cryptocurrency trading with ChatGPT

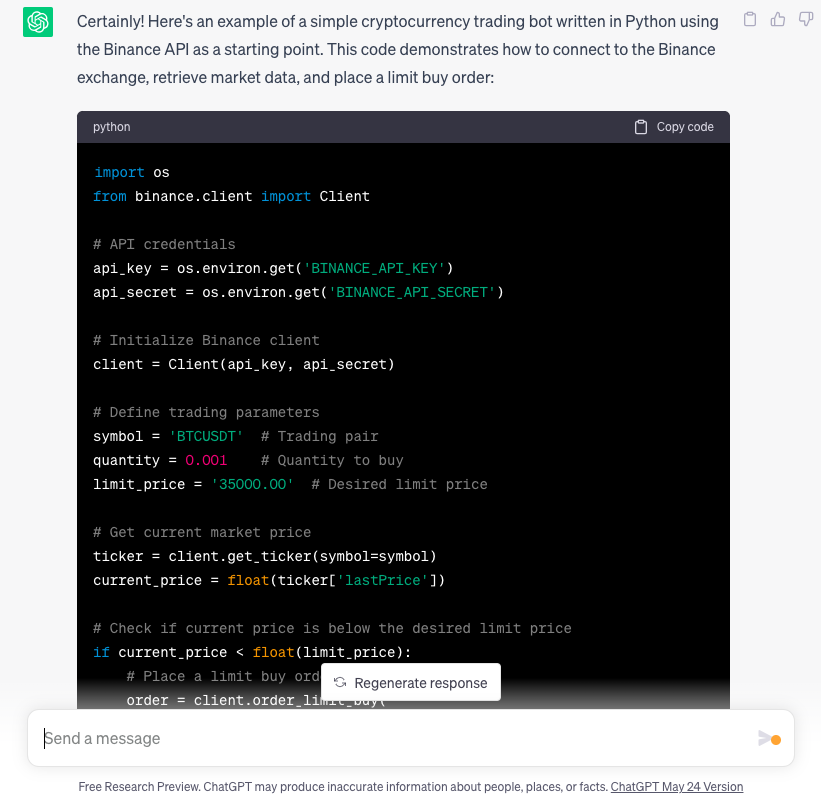

ChatGPT is not an ordinary tool but a language model powered by cutting-edge natural language processing (NLP) technology. While its versatility extends to language-based tasks, analytics and content, its application in cryptocurrency trading is equally attractive. Cryptocurrency traders can unlock a new level of automation by harnessing ChatGPT’s data analysis and code generation capabilities.

It’s easy to imagine a scenario where traders tap into ChatGPT’s potential by asking it to create code for specialized crypto trading bots. These bots, driven by predefined parameters, can automate the trading process, saving time and effort.

Source: ChatGPT

ChatGPT — An ultimate tool for crypto trading?

ChatGPT has opened doors for traders, providing them with a powerful tool to revolutionize their strategies and streamline their trading operations. However, exercising caution and thoroughly testing the resulting bots before deploying them in live trading environments is crucial.

The key is understanding that ChatGPT is the underlying technology for these specialized bots. While it has remarkable analytical capabilities and the ability to generate code, prudent traders understand the importance of conducting extensive testing and validation to ensure the effectiveness and reliability of such AI-powered solutions.

Although ChatGPT can assess financial risks in addition to active trading, it needs further development to compete with specialized teams. The United States-based crypto exchange Coinbase recently tested ChatGPT’s ability to monitor the risk of ERC-20 tokens before listing. The results were compared to risk assessments performed by Coinbase’s security team, which uses specialized automation tools. Using internal tools, the team reached 20 random smart contract risk assessments between ChatGPT and its automated security check. ChatGPT agreed with Coinbase’s assessments in 12 of those cases. However, for the remaining eight cases, ChatGPT incorrectly identified a high-risk asset as low-risk — a critical error, according to Coinbase, as underestimating the risk assessment is more damaging than overestimating it.

Advertisement

Claim your wallet ID and do crypto on/off-ramp, effortlessly. Ready, set, XGo!

ChatGPT vs. automated trading bots

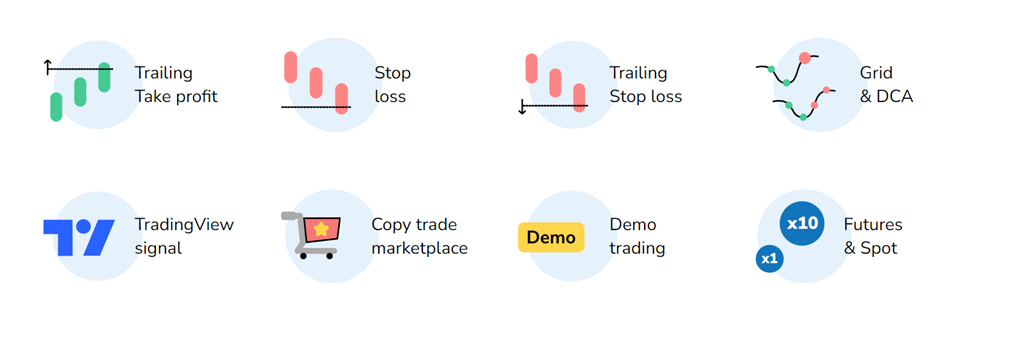

By introducing advanced trading tools and sophisticated algorithms, specialized trading bots like those provided by TradeSanta are a promising solution to effectively overcome ChatGPT’s limitations in the dynamic crypto trading environment.

TradeSanta cryptocurrency bots offer several advantages over ChatGPT or other AI-driven trading bots. Firstly, TradeSanta provides diverse capabilities, including spot and futures trading, long and short trading options, risk management tools and customizable bot templates.

Source: TradeSanta

Furthermore, TradeSanta bots are operated by humans, which gives them the advantage of in-depth knowledge and the ability to follow and learn from current events. This human element allows the bots to adapt to changing market conditions, news, events and regulatory changes, enhancing their decision-making capabilities.

Cryptocurrency markets are highly volatile and require quick decision-making based on real-time data. This is why TradeSanta also offers various tools to process vast amounts of data simultaneously and execute trades accordingly. ChatGPT-based bots may face challenges in processing data at the required speed, potentially resulting in missed trading opportunities or delayed execution.

Additionally, TradeSanta understands that not all users may possess extensive knowledge of trading strategies. To address this, it provides helpful guides and support to assist users in articulating their desired strategy effectively. This ensures the resulting strategy is efficient and aligned with the user’s goals. In contrast, ChatGPT-based bots may face challenges in understanding and implementing trading mechanisms without clear and detailed descriptions from users.

ChatGPT still has its limitations

It’s still too early to declare AI-driven trading bots as the ultimate replacement for specialized tools. While impressive, ChatGPT has its limitations and can’t quite grasp the mind-bending intricacies of the crypto market like a human can. The groundbreaking AI solution also lacks key features that users rely on for their trading.

Meanwhile, dedicated platforms like TradeSanta offer in-depth understanding of the crypto market and advanced features like real-time data processing, human-operated expertise and support for users. These factors contribute to TradeSanta’s ability to execute advanced trading strategies and stay attuned to market dynamics, giving traders a competitive edge in the crypto market.